It’s completely easy to just forget that it takes exceptional effort and work when you’re elbow-deep in popcorn at your

When you’re a high-profile celebrity, your paycheck worth millions of dollars doesn’t always go directly into your bank account. First,

Celebrities have been known to live completely different life than most of us. While many of us may consider getting

They always say that quality is important over quantity. For some actors, however, quality can also mean quantity. They are,

For many of us, watching a movie is a form of art and entertainment. We want to be amused and

Poverty is not an unusual story for a lot of people. There are those who find it difficult to get

There are plenty of Hollywood stars who worked their way up because they dreamed of it. Others found themselves thrust

For many people, finding success in life must require an early investment in the things and skills they love and like. After

Celebrities are not just stars in their own right, but they have also played a part in the success of

Acting, like so many industries, is pretty much built around experiences. While many people may think that they can just

Dating your friend’s ex is a no-no. But, in the world of celebrities, the opposite appears to be true! There

We’re always trying to figure out who’s dating who. So, the public finds celebrity dating to be exciting. We all

Some A-list couples look good together. They get charming couple names like Brangelina or Kimye. And it seems like destiny

For many people, finding success in life requires an early investment in the things and skills you love and like. After all,

Suffice to say, many of us want to be celebrities and land acting credits in our own movies or sing

Taking a glimpse at the life of a celebrity can be overwhelming sometimes. While it is a dream for many

The entertainment industry has shined its spotlight on numerous people through the years. From singers to actors to athletes, there’s

While a few people cringe at the idea of dating co-workers, actors naturally form a romance with fellow stars whom

Taylor Swift is undeniably very descriptive with her songs. She has become known for her incredible songwriting skills, including writing

Sometimes, you just get in a mood to feel the romantic stirrings with a movie that makes you swoon and

KATHERINE WEBB – WIFE OF A. J. MCCARRON Before Katherine Webb became known as A.J. McCarron’s wife, she is also

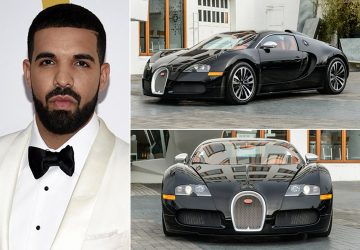

Jay Leno – 1994 McLaren F1 – $12 Million Jay Leno is a well-known comedian, television host, producer, writer, and

Hazel Moder – Julia Roberts and Daniel Moder’s Daughter Julia Roberts and her husband Daniel Moder, are blessed with three

MONICA LEWINSKY – $1.5 MILLION Monica Lewinsky rose to prominence when she got linked to a former high-ranking politician in

Most people are inspired to lose weight by their favorite celebrities. Whenever they see their much-loved stars shed off the

click on “Next Page” at the bottom to see some of the most expensive & luxurious Celebrity houses. Some of

BETTY LYNN – 93 Retired actress Betty Lynn rose to the pedestal of mainstream cinema from the 40s until the